dupage county sales tax vs cook county

That will help your resale value. Persons under 5 years percent.

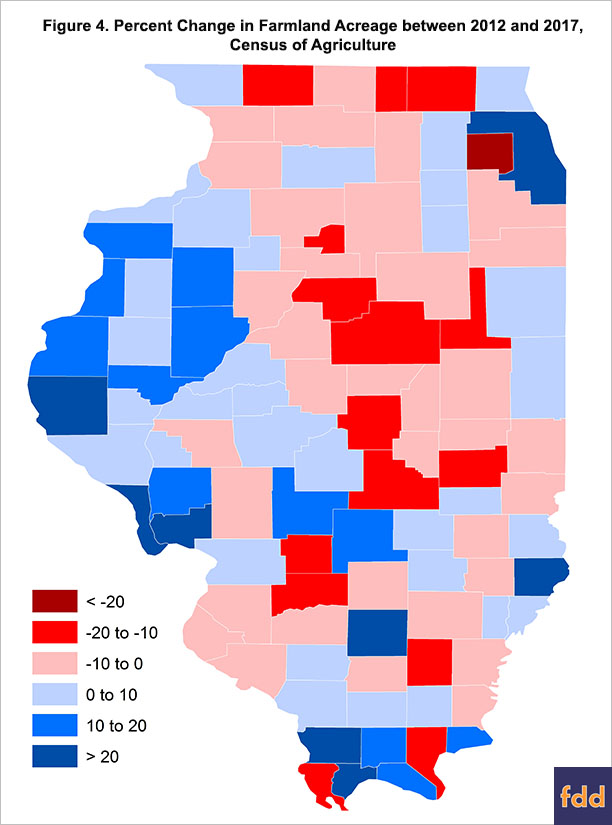

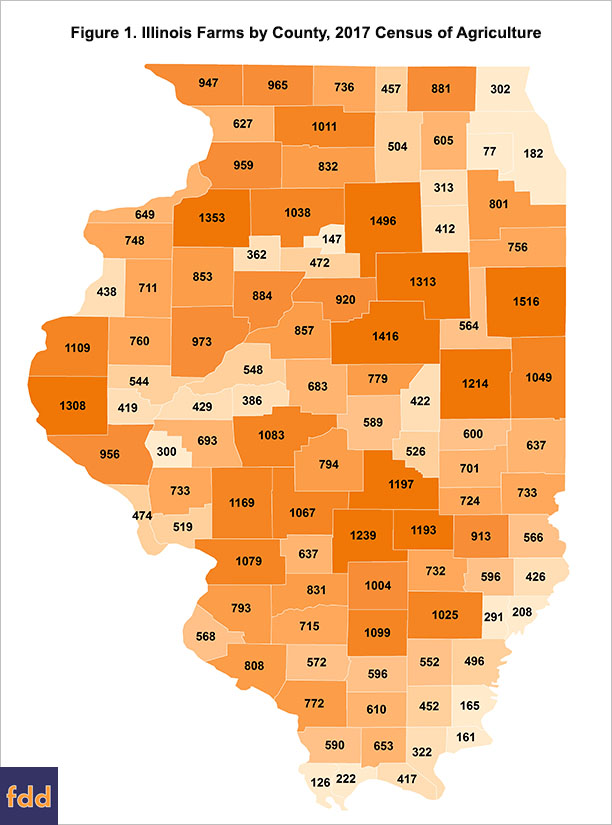

Changes In Farms And Farmland In Illinois Farmdoc Daily

Q--You live in DuPage County and buy a car in.

. 0610 cents per kilowatt-hour. Commuters from Naperville for instance pay a minimum of 775 in combined sales taxes. The base sales tax rate in DuPage County is 7 7 cents per 100.

The 2018 United States Supreme Court decision in South Dakota v. Population estimates base April 1 2010 V2019 5195026. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate.

Lowest sales tax 625 Highest sales. By Annie Hunt Feb 8 2016. In DuPage County property tax rates vary widely between suburbs with 2005.

Dupage County Illinois Sales Tax Rate 2022 Up to 105 Dupage County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dupage County does not. A--A 65 percent tax plus 075 percent that either will be collected by the dealer and forwarded to Cook County or be billed by Cook County to you. If youre looking to buy a house the two big numbers youll want to look at are property taxes and quality of schools.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. If youre renting that wont matter as much. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. These rates were based on a tax hike that dates to 1985.

Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties. 1337 rows 2022 List of Illinois Local Sales Tax Rates.

The Dupage County sales tax rate is. Population percent change - April 1 2010 estimates base to July 1 2019 V2019-03. Lowest sales tax 625 Highest sales.

Payments must be received at the local bank prior to close of their business day to avoid a late payment. To review the rules in Illinois visit our state-by-state guide. Cook has higher sales taxes but both Cook and DuPage have higher property taxes depending on which town youre in.

Has impacted many state nexus laws and sales tax collection requirements. So if a county website says the average tax rate for the county is 75 per hundred dollars of value a builders sales rep will probably say that the rate is 25 25 per hundred dollars of sale price 13 of 75. Population Census April 1 2010.

Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025. DuPage County Board Chairman Dan Cronin DuPage Water Commission Chairman Jim Zay and members of the County Board celebrated the sales tax decline with a cake at the May 24 County Board meeting. The drop in sales tax will save DuPage County consumers 36 million annually.

I am in Dupage and my property taxes have ranged between 15 and 25 depending on market conditions and school funding needs for single family detached as well as condo properties I have owned. The Illinois sales tax of 625 applies countywide. Recently I looked online at a 2 flat in a Cook County suburb and nearly fell out of my chair when the real estate agent told me what the property taxes were.

While its true that Illinoiss state sales tax of 625 is lower than Indianas state sales tax of 7 its also true that many cities and counties assess their own sales taxes. In addition to the sales tax reduction the commission lowered its water rates by 1 percent for. According to the Office of the Will County Clerk the 2005 average Will County property tax rate.

Cook County IL DuPage County IL Population estimates July 1 2019 V2019 5180493. Payments must be received at the local bank prior to close of their business day to avoid a late payment.

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Ballot Language Vote Yes For Fairness

Understanding The Diversity Of Asian American Voters Third Way

Changes In Farms And Farmland In Illinois Farmdoc Daily

Chicago Area Property Taxes Higher Than 93 Percent Of Biggest Counties Crain S Chicago Business

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates

More Than Half Of Illinois 102 Counties At High Covid Alert Status Nbc Chicago

Menifee County Sheriff S Office Facebook

Fake Newspapers Misleading Will Dupage County Residents State Senator Joliet Il Patch

Understanding The Diversity Of Asian American Voters Third Way

Understanding The Diversity Of Asian American Voters Third Way

Understanding The Diversity Of Asian American Voters Third Way

Understanding The Diversity Of Asian American Voters Third Way

Egg Lectic Cafe Wheaton Illinois Sweet Home Wheaton Illinois Wheaton